If you are having trouble getting Wells Fargo to modify your mortgage loan, you most likely have correspondence similar to mine, shown below. You’ve most likely experienced Wells Fargo misleading you about loan modification, then taking no responsibility, nor in fact talking honestly about what it has done.

If you are having trouble getting Wells Fargo to modify your mortgage loan, you most likely have correspondence similar to mine, shown below. You’ve most likely experienced Wells Fargo misleading you about loan modification, then taking no responsibility, nor in fact talking honestly about what it has done.

Bank of America did the same, even giving bonuses to employees who falsely denied loan modifications. But now, 6 former employees have come forward to tell the truth in court.

Former Employees: Bank of America Used Dirty Tricks to Force People into Foreclosure ~ Read more.

HAMP ~ Home Affordable Modification Program

In response to rapidly deteriorating financial market conditions in the late summer and early fall of 2008, Congress enacted the Emergency Economic Stabilization Act, P.L. 110-343, 122 Stat. 3765. The centerpiece of the Act was the Troubled Asset Relief Program (TARP), which required the Secretary of the Treasury, among many other duties and powers, to “implement a plan that seeks to maximize assistance for homeowners and . . . encourage the servicers of the underlying mortgages . . . to take advantage of . . . available programs to minimize foreclosures.” 12 U.S.C. § 5219(a). Congress also granted the Secretary the authority to “use loan guarantees and credit enhancements to facilitate loan modifications to prevent avoidable foreclosures.”

Pursuant to this authority, in February 2009 the Secretary set aside up to $50 billion of TARP funds to induce lenders to refinance mortgages with more favorable interest rates and thereby allow homeowners to avoid foreclosure. From Wigod v. Wells Fargo ~ Read more

While it is clear that Wells Fargo has certain obligations under the HAMP program, it is nonetheless true that that does not confer a private right of action on people to enforce the requirements of the HAMP program. That is to say, if Wells Fargo qualified you for a loan modification under HAMP, gave you a trial period which you successfully completed, and then Wells Fargo reneged, you can’t use that as grounds in your foreclosure for dismissal of the complaint. That’s because the HAMP Guidelines are between the government and banks. Those are the “parties” who may bring a law suit based on the guidelines.

However, according to the 7th Circuit’s opinion in Wigod v Wells Fargo, it does give you the right to bring a court action under your state’s laws against consumer fraud. Wigod v. Wells Fargo supports everyone who has been offered a HAMP trial period and then was dishonestly denied loan Modification.

Wigod v. Wells Fargo ~ Read more.

NOTE: If your home has been in foreclosure with the same mortgage twice before and it was dismissed each time a third foreclosure is barred. Sometimes a second foreclosure is barred. Using Res Judicata to Stop Foreclosure ~ Read more.

Millions withdrawn from Wells Fargo b/c of its dishonesty

October 15, 2011 ~~ Happiness!!!

Accounts closed ~~ Millions withdrawn from Wells Fargo and Bank of America because of their dishonest treatment of people seeking loan modifications. Every time I watch these videos, it warms my heart.

The following is why I love seeing a church support borrowers who were mistreated by Wells Fargo: I wrote to Wells Fargo about Wells Fargo’s unorthodox behavior in relation to Wells Fargo’s HAMP loan modification offer, which Wells Fargo cancelled even though I did what was required. Wells Fargo’s answers (below) were not honest.

12/23/09 – Tweet your Wells Fargo problems, and retweet the problems of others, that way anyone thinking of taking their account to Wells Fargo will have a better idea of what Wells Fargo is like. http://twitter.com/ I’m ConsiderThis1

12/23/09 – Just received this email:

Something needs to be done.

I have searched for hours on their lies and cheating ways. I have found many negative things on the web but I have yet to find anyone with a positive outcome.

People have posted letters to congress, representatives, law enforcement, etc.

I’ll not bore you with the same old story.

In summary, Wells Fargo lied to me on multiple phone calls. It started about 18 months ago. My credit was near 800 and I had never missed any payment on anything in my entire life (I’m 34).

Now I’m 6 months past due on my mortgage, my credit hovers around 600 and I have had 6 of my 7 credit cards cancelled by the creditors. I don’t use credit so it’s not really an issue.

It will take 20 grand to make my loan current.

All I ever did was what Wells Fargo asked of me.

Last week I sent them updated hardship letter, paystubs, etc. In my frustration from having done this countless times, I forgot to sign and date them. They cancelled any & all programs I was on and have denied my request for a mod. Blah blah. I”m rambling.

I was only curious if you have gotten anywhere with them. Based on the letters you wrote to them, you seem to have some legal experience. I’m just a dumb street cop so my knowledge of legal correspondence with these people is limited. I’d appreciate any advice, or any shared stories about their heinous practices.

Sincerely,

12/22/09 – Here’s another email

I”m going all out. I have Ben Windust’s phone number, email, and work address. I’m sending letters and emails to my Congressman, Senator, Consumer Advocate, Better Business Bureau, local news programs, the Dept of the Treasury, etc. etc. etc. At all times Wells Fargo will be copied. I’m also in contact with a lawyer regarding a nationwide class action lawsuit. I may set up a website for interested persons.

What Wells Fargo has perpetrated is more than incompetence or indifference, it’s evil.Also, here’s a possibly useful phone number: Wells Fargo Executive team @ 1-800-853-8516.

I’m still in my home

One thing that helped was having people go with me to hearings. The more “pillar of the community” the more it seems to help. Fighting foreclosure is hard on ones health, so take extra care of yourself.

Letter to Wells Fargo:

Karen Marie Kline Santa Fe, New Mexico 87507 Loan number Number at top of letter from you:

October 28 , 2009

Written Correspondence Wells Fargo Home Mortgage PO Box 10335Des Moines, IA 50306-0335Dear Wells Fargo,

Before I write for help from US government entities assigned to deal with bank/mortgage problems, I have been advised to write to you in hopes of resolution. I am, therefore, writing to you.

My problem is that Wells Fargo and its lawyers appear to be using HAMP loan modification to avoid discovery rather than for the purpose for which it was created and I am asking Wells Fargo:

1.) to recognize that I finalized Wells Fargo’s offer of a trial period in HAMP when I called Wells Fargo on September 26, 2009 and scheduled my three HAMP trial period payments;

2.) to send me the package of information that I was promised by Wells Fargo in the event I finalized Wells Fargo’s offer of a HAMP trial period; and

3.) to remove any legal fees that were or might be billed to me from September 22, 2009 when I was offered the HAMP trial period, or alternatively from September 26, 2009 when I finalized my acceptance of the offer.

Here is what has happened:

I applied to Wells Fargo for Home Affordable Modification Program help in March, 2009. I enlisted HOPE NOW help and a counselor called in with me several times. During one call, several months down the road, we were told that my file had not been updated since 2005.

I repeatedly complied with Wells Fargo’s requests that I send in my documents with current dates and new signatures.

At the same time I have been counterclaiming in Wells Fargo’s foreclosure action that Wells Fargo has dealt with me in bad faith. In order to prosecute my case I sent Interrogatories and Requests for Production to Wells Fargo via its lawyers. In response I was given only three answers: the name of the person actually answering the questions, her job title: lawyer, and her work address.

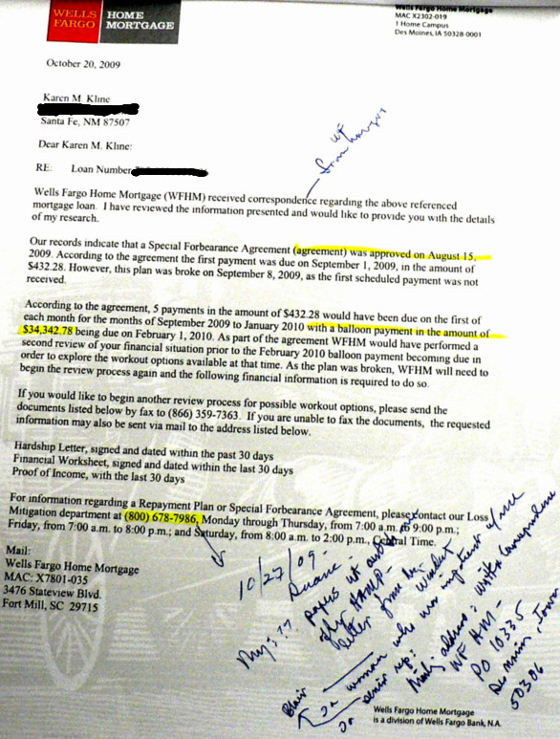

Thereafter I sent a letter pursuant to rule 1-037 NMRA requesting proper answers to my other questions and I explained why I needed them. When the deadline for proper responses drew near Ms. Charney’s legal assistant called me and said that they weren’t going to answer my discovery and that I was in a forbearance plan. Only I’d never heard about any forbearance plan prior to the legal assistant mentioning it.

Thereafter Wells Fargo sent me a letter saying there was a moratorium during the forbearance plan, and that I should sign the enclosed agreement. However, the agreement said I would pay $480+/- a month on my mortgage followed by a balloon payment in February, 2010 of about $34k. I don’t have that kind of money, for either the $480 monthly payments or the huge balloon, so I could not in honesty sign the agreement and I did not.

I filed with the court a statement that I would agree to a two week delay but after that I had to work on prosecuting my case. Although Ms. Charney and her assistant said they would file something re the moratorium, they did not file anything.

In time I sent Wells Fargo Requests for Admissions, many of which mirrored my Interrogatories. None of my Admissions was timely denied. As a result the Admissions are deemed admitted and conclusively established under Rule 1-036 NMRA.

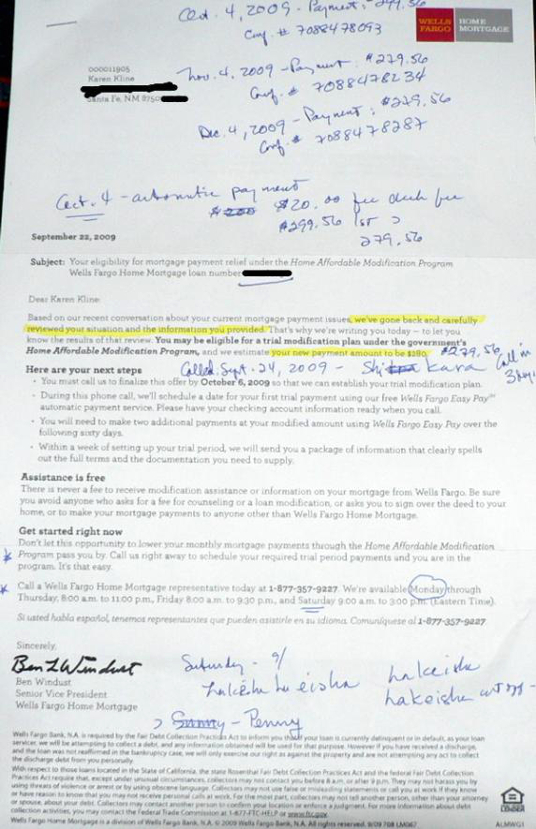

Meanwhile, on September 22, 2009, just before the deadline to deny, Wells Fargo wrote to me offering a Home Affordable Modification Program Trial Period. In its letter Wells Fargo wrote that I could “finalize this offer” by calling in by October 6, 2009 so that Wells Fargo could “establish your trial modification plan.” The letter also said, “Within a week of setting up your trial period, we will send you a package of information that clearly spells out the full terms and the documentation you need to supply.”

I finalized the offer by calling in on September 26, 2009 and scheduling three modification plan payments for which I was charged $20 (whereas Wells Fargo’s letter had said it would be free). Thereafter I did not receive the package of information that had been promised in the September 22, 2009 letter.

At the same time Wells Fargo’s lawyers refused to agree to vacate the October 19, 2009 foreclosure hearing on Wells Fargo’s motion for summary judgment. This was particularly worrying to me because HAMP guidelines specifically say that foreclosure is to be suspended during the trial period.

At the last minute Wells Fargo’s lawyers produced a motion to continue, while still refusing to sign the simple order I had proposed to vacate the hearing. I objected that continuing is not the same as suspending. Ms. Charney refused to talk to me on the phone about the October 19, 2009 summary judgment hearing. She hung up when I answered and did not return any of my three calls when I called back and left messages. I also objected that the lawyers were dishonest in their motion to continue and had falsified the order when they filled in the line above my name saying they had been unable to reach me.

At the hearing I quoted from the Home Affordable Modification Program Guidelines repeatedly and repeatedly said that the hearing should not have been held.

On October 27, 2009, I received a letter from Wells Fargo dated October 20, 2009 saying that a forbearance plan had been approved (failing to note that I had not been able to agree because of the huge amounts of money it required from me) and that because I did not keep the agreement I was taken out of the trial period.

I immediately called Wells Fargo at the number listed: 1-800-678-7986, and spoke with a series of Wells Fargo representatives beginning with Duane, and progressing to a senior rep named Blair. Basically I was told that on October 20, 2009 Wells Fargo’s lawyers told Wells Fargo to take me out of the HAMP trial period.

I am concerned by this because it appears to be a tactic meant to punish me for not going along with the deceit the lawyers incorporated into their Motion to Continue, as well as a tactic to avoid responsibility for refusing to vacate the hearing on their motion for summary judgment which the HAMP guidelines clearly say should not have been held while I was in the trial period.

The problem, then, is that Wells Fargo and its lawyers appear to be using the HAMP trial period to avoid discovery rather than for the objectives identified by the United States government when the program was set up and Wells Fargo agreed to participate; and, Wells Fargo’s lawyers appear to have violated the HAMP guidelines be refusing to sign the simple order vacating Wells Fargo’s summary judgment hearing.Further, it is not acceptable under HAMP to ask me, a borrower, for cash for the Modification, so that appears to mean that the $20 fee to set up my three trial period payments was not envisioned by the US Treasury.

Arbitrarily excusing/explaining the termination of my HAMP trial period on the basis of my non-agreement to the $34k balloon payment that was part of Wells Fargo’s $480+/- monthly payment forbearance plan appears to violate the same HAMP guideline. (I’m not sure it was all right for Wells Fargo to ask me to pay the Escrow Account, which I did pay in the amount of more than $400.)

The fact that Wells Fargo said it would not cooperate with discovery, the fact that my HAMP trial period was instituted before a critical discovery deadline, and the fact that Wells Fargo and its lawyers arbitrarily terminated my trial period the day after the prohibited hearing at which they were given a stay of discovery, gives the appearance of Wells Fargo using the HAMP program to avoid discovery.

In order to resolve the foregoing problems in the simplest terms possible I am asking Wells Fargo:

1.) to recognize that I finalized Wells Fargo’s offer of a trial period in HAMP when I called Wells Fargo on September 26, 2009 and scheduled my three HAMP trial period payments;

2.) to send me the package of information that I was promised by Wells Fargo in the event I finalized Wells Fargo’s offer of a HAMP trial period; and

3.) to remove any legal fees that were or might be billed to me from September 22, 2009 when I was offered the HAMP trial period, or alternatively from September 26, 2009 when I finalized my acceptance of the offer.

Sincerely,

Karen Marie Kline

Interrogatories to Wells Fargo ~ Read more.

Requests for Production to Wells Fargo ~ Read more.

Requests for Admissions to Wells Fargo ~ Read more.

Karen Marie Kline Santa Fe, New Mexico 87507 Loan number Number at top of letter from you: XXXXX

November 8, 2009

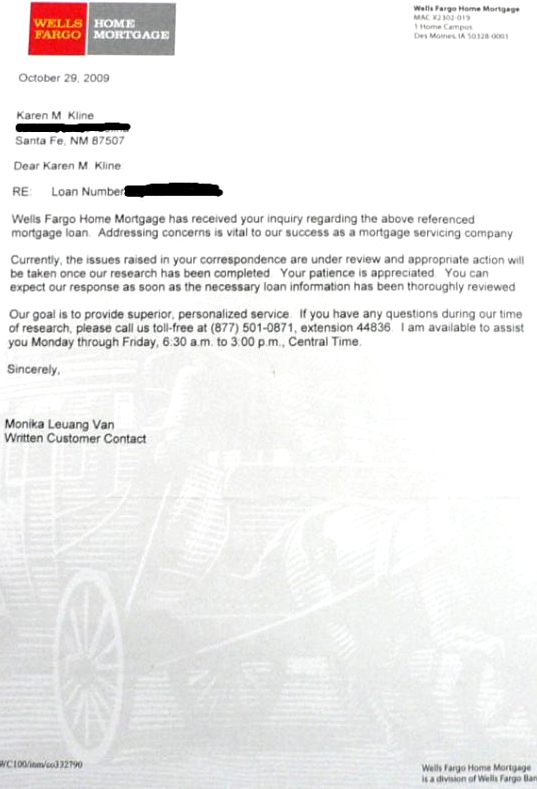

Monika Leuang Van Written Correspondence Wells Fargo Home Mortgage PO Box 10335 Des Moines, IA 50306-0335Dear Ms. Van,

Your letter dated October 29, 2009 sounds generic and doesn’t answer any of my questions.

Basically, I am concerned that Wells Fargo Home Mortgage used the Home Affordable Modification Program “HAMP” trial period to avoid discovery rather than for its intended purpose. I was about to write to the Comptroller of the Currency Administrator of National Banks to complain when I read that I’m supposed to write to the bank first, that’s why I wrote to Wells Fargo Home Mortgage Written Correspondence.

Here, more concisely are my questions:

1. Why I was not sent the things which Sr. Vice President Ben Windust’s letter of September 22, 2009 clearly stated would be sent to me after I finalized my acceptance of Wells Fargo’s HAMP trial period offer by calling in before October 6, 2009 and scheduling three payments at the new rate provided to me under HAMP? (I finalized on September 26, 2009.)

2. When will I be sent the things that were promised if I finalized Wells Fargo’s HAMP trial period offer?

3. Where in HAMP US Treasury Guidelines does it permit lawyers to use the trial period to avoid discovery? (Wells Fargo phone reps said the correspondence upon which my cancellation was based was from Wells Fargo lawyers.)

Surely my “necessary loan information” was thoroughly reviewed before offering me the HAMP trial period. Wasn’t it?

So, the questions now are those above: 1-3.

I look forward to your specific answers and to having my finalized trial period reinstated. I will gladly wait another ten days for resolution.

Sincerely,

Karen Marie Kline

The Comptroller seems to be in the control of Wells Fargo.

The best I got out of this was a letter telling me I could file for Morgage Review. Which I did. It was settled when banks paid their employee reviewers $10,000 each, and people like me got $500.

Karen Marie Kline Santa Fe, New Mexico 87507 Loan number Number at top of letter from you:

November 8, 2009

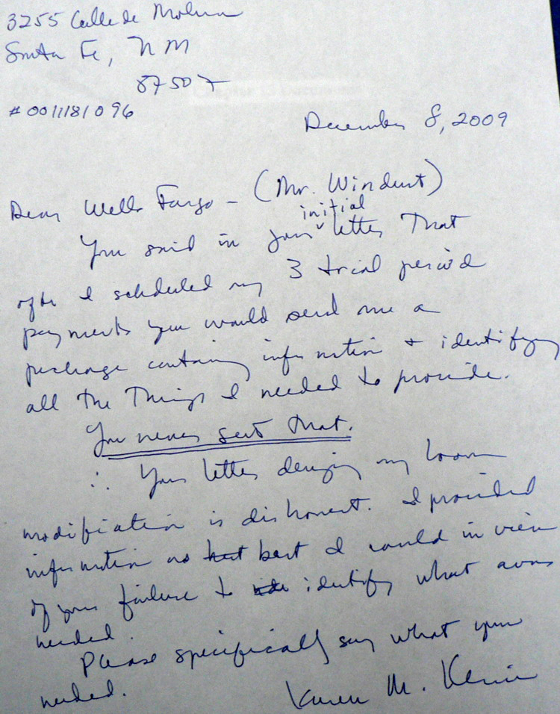

Ben Windust, Senior Vice President Wells Fargo Home Mortgage PO Box 10368 Des Moines, IA 50306-0368Dear Mr. Windust,

When I called Wells Fargo Home Mortgage about the cancellation of my Home Affordable Modification Program “HAMP” trial period after I had finalized my acceptance of Wells Fargo’s offer, see attached letter from you with my notes, and one day after Wells Fargo achieved a stay of my discovery I was told to write to “Written Correspondence”; a copy of my letter is attached.

Wells Fargo’s response dated October 29, 2009 sounds generic and doesn’t answer any of my questions.

Basically, I am concerned that Wells Fargo Home Mortgage used the HAMP trial period offer that it extended to me to avoid discovery rather than for the trial period’s intended purpose. I was about to write to the Comptroller of the Currency Administrator of National Banks to complain when I read that I’m supposed to write to the bank for resolution first.

Here are my questions and the issues needing resolution:

1.Why I was not sent the things which your letter of September 22, 2009 clearly stated would be sent to me after I finalized my acceptance of Wells Fargo’s HAMP trial period offer by calling in before October 6, 2009 and scheduling three payments at the new rate provided to me under HAMP? (I finalized on Saturday, September 26, 2009.)

2.When will I be sent the things that were promised to me by you and Wells Fargo if I finalized Wells Fargo’s HAMP trial period offer?

3.Where in HAMP US Treasury Guidelines does it permit lawyers to use the trial period to avoid discovery? (Wells Fargo phone reps said the correspondence upon which my cancellation was based was from Wells Fargo lawyers. See attached letter.)

I look forward to specific answers and to having my finalized trial period reinstated

.Because I began asking Wells Fargo Home Mortgage for Home Affordable Modification in March, 2009, and, I resubmitted my information on a nearly monthly basis, I trust Wells Fargo Home Mortgage had ample time to thoroughly review my necessary loan information prior to you sending me Wells Fargo’s offer of the HAMP trial period.

That being true, I trust that ten additional days will be ample time for resolution of the issues that I have presented to include reinstating my HAMP trial period and sending me the promised materials and documents.

Sincerely,

Karen Marie Kline

Copy of top letter is attached

They are crooks. they gave me a HAMP agreement and wanted payment on the 1st but as I explained to them I get my SSI on the 15th. They said no problem, but they cancelled me after my first payment. They are unscrupulous.

I’m so sorry to hear that, Karl. Too many Americans side with banks on the false belief that morality requires foreclosures. If those same Americans took fraud and dishonesty into account they could not side with banks.

Please will you help change the consciousness re foreclosure and banks? Check out this page: http://www.looking-good.org/angel-day-11/