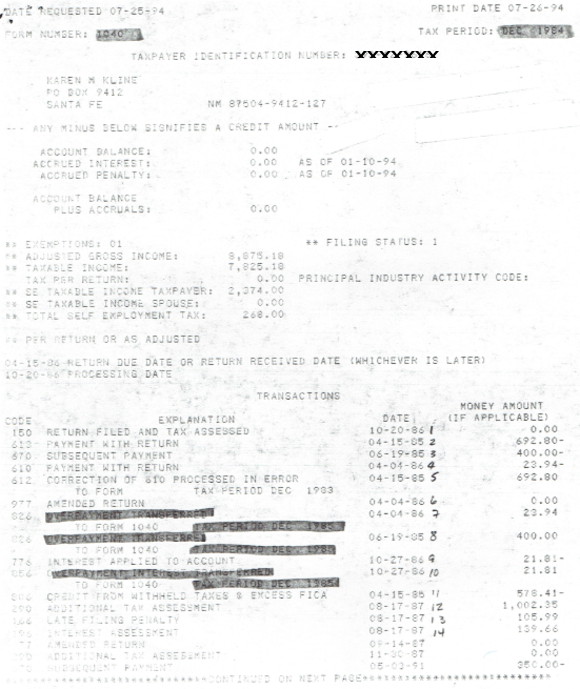

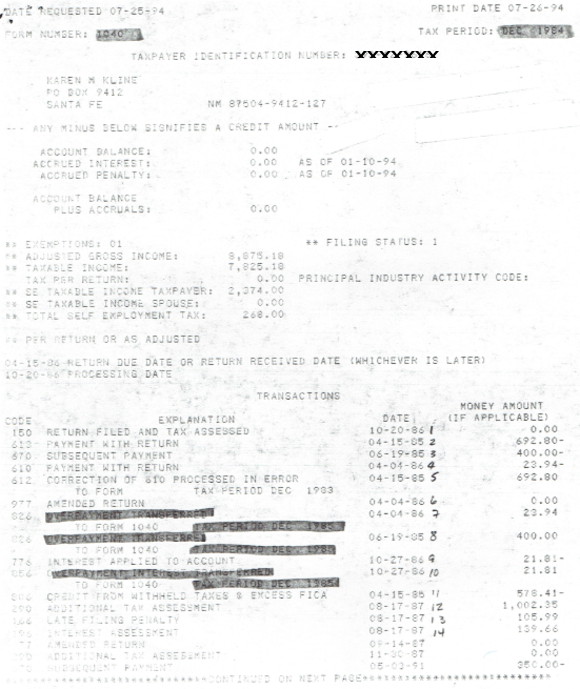

The original was very faint. And, back then yellow highlighting resulted in dark gray/black. I can’t find the original, so I’m stuck with copies from my primitive copier of the time.

For clarity, I put the information into tables for easy viewing.

Print Date 7-26-94

Transactions Explanation Retyped for Clarity

| Lines | Description | Date | Amount |

| | | |

| Line 1 | Return filed and tax assessed | 10-20-86 | 0.00 |

|  | | |

| Line 2 | Payment with return | 04-15-85 | 692.80- |

|  | | |

| Line 3 | Subsequent payment | 06-19-85 | 400.00- |

| Line 4 | Payment with return | 04-04-86 | 23.94- |

| Line 5 | Correction of ??? processed in error

to form tax period Dec 1983 | 04-15-85 | 692.80 |

| Line 6 | Amended return | 04-04-86 | 0.00

|

| Line 7 | Overpayment transferred to

form 1040 tax period Dec 1985 | 04-04-86 | 23.94 |

| Line 8 | Overpayment transferred to

form 1040 tax period Dec 1985 | 06-19-86 | 400.00 |

| Line 9 | Interest applied to account | 10-27-86 | 21.81- |

| Line 10 | Overpayment interest transferred

to form 1040 tax period Dec 1985 | 10-27-86 | 21.81 |

| Line 11 | Credit from withheld taxes

and excess FICA | 04-15-85 | 578.41- |

| Line 12 | Additional tax assessment | 08-17-87 | 1,002.35 |

| Line 13 | Late filing penalty | 08-17-87 | 105.99 |

| Line 14 | Interest assessment | 08-17-87 | 139.66 |

| Line 15 | Amended return | 09-14-87 | 0.00 |

| Line 16 | Additional tax assessment | 11-30-87 | 0.00 |

| Line 17 | Subsequent payment | 05-03-91 | 350.00 |

Transactions Explanation Pg 2 Retyped for Clarity

| Line | Explanation | Date | Amount |

| | | |

| Line 18 | Subsequent payment | 06-27-91 | 209.31- |

| Line 19 | Interest assessment | 07-22-91 | 341.41 |

| Line 20 | Penalty for late payment of tax | 07-22-91 | 105.97 |

| Line 21 | Credit reapplied from A to 820 Transfer-Out from

form 1040 tax period Dec 1985 | 06-19-85 | 400.00- |

| Line 22 | Credit reapplied from A to 820 Transfer-Out from

form 1040 tax period Dec 1985 | 04-04-86 | 23.94- |

| Line 23 | Reversal of overpayment interest transferred from

form 1040 tax period Dec 1985 | 10-27-86 | 21.81- |

| Line 24 | Abatement of penalty for late payment of tax | 03-29-93 | 105.97- |

| Line 25 | Abatement of interest | 03-29-93 | 378.12- |

| Line 26 | Overpayment transferred to form 1040

for tax period Dec 1989 | 05-03-91 | 86.23 |

| Line 27 | Overpayment transferred to form 1040

for tax period Dec 1990 | 05-03-91 | 76.64 |

| Line 28 | Overpayment transferred to form 1040

for tax period Dec 1990 | 06-27-91 | 284..32 |

| Line 29 | Interest applied to account | 03-29-93 | 64.90- |

| Line 30 | Refund of overpayment | 03-29-93 | 613.66 |

| Line 31 | Interest applied to account | 03-29-93 | 66.11- |

| Line 32 | Subsequent payment | 06-27-91 | 557.66- |

|  | | |

| Line 33 | Correct subsequent payment processed in error

to form 1040 tax period Dec 1985 | 06-27-91 | 557.66 |

| Line 34 | Reversal of Interest applied to account | 03-29-93 | 66.11 |

| Line 35 | Interest assessment | 04-05-93 | 14.15 |

| Line 36 | Credit reapplied from A to 820 Transfer-Out from

form 1040 tax period Dec 1989 | 05-03-91 | 86.23- |

| Line 37 | Credit reapplied from A to 820 Transfer-Out from

form 1040 tax period Dec 1990 | 05-03-91 | 76.64- |

| Line 38 | Credit reapplied from A to 820 Transfer-Out from

form 1040 tax period Dec 1990 | 06-27-91 | 284.32- |

| Line 39 | Interest applied to account | 03-29-93 | 53.52- |

| Line 40 | Abatement of interest | 10-11-93 | 9.44- |

| Line 41 | Additional tax assessment | 12-13-93 | 0.00 |

| Line 42 | Interest assessment | 12-13-93 | 1.56 |

| Line 43 | Abatement of late filing penalty | 08-17-87 | 20.11- |

| Line 44 | Abatement of interest assessment | 12-27-93 | 109.22- |

| Line 45 | Additional tax assessment | 12-27-93 | 0.00 |

Okay, that was the 1994 print-out.

(The original was very faint…)

Preceding Page <~~~> Following Page